Three lessons from banking glitches – “why should I stay with you?”

Banks have been given short shrift recently by customers in the wake of online banking outages in 2015. Besides temporarily denting product advocacy, the issue is morphing into a reputational issue, with customers hostile to repeat offenders and, more crucially, unappeased by the casting of online banking outage as a technical error or “glitch”*.

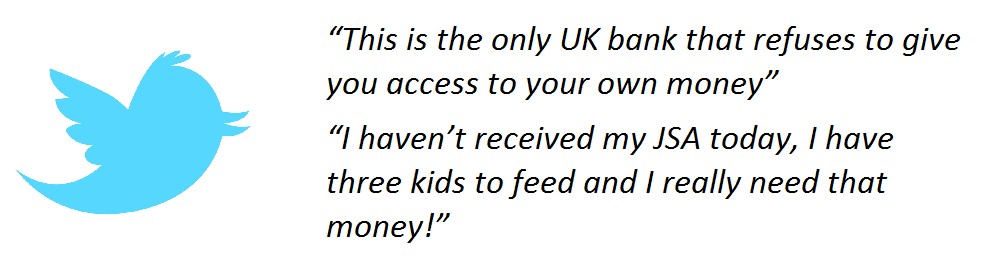

In response, banks often enlist their Twitter response team reserves and explain the event in terms of “a few glitches”. Yet the question that customers are really asking is much weightier: “why has my right to uninterrupted access to my money been infringed?” Given the perceptions of stakeholders are paramount to reputation, alva’s analysis of banking glitches in January-June 2015 reveals three key lessons in responding to customers:

1: Use appropriate language. A glitch is no longer just a glitch.

alva’s data towards banks and building societies affected by outages shows they are no longer treated as an innocuous “glitch” but instead are tantamount to negligence which results in the withdrawal of the customer’s right to his or her money. Avoiding phrases like “a few glitches” can help avoid a perception of playing down the impact of the event on customers.

2: Remove ambiguity as soon as possible.

As with the introduction of new payments technology Paym and Apple Pay, ambiguity over when updates announcements are to be made can be a source of customer angst. This turns into “panic” when the uncertainty is around when access to the customer’s money will be restored. Regular and scheduled update announcements are a way of stemming criticism.

3: Provide future reassurances.

Online banking outages have recently struck at the most inopportune times and precedent shows that no bank is immune to such an event. Moreover, as branches close and customers come to rely on online banking as their main channel for account management, anxieties around the reliability of online payments are set to rise – a clarion call for banks to provide reassurances to their customer bases reflective of the reputation risk such events harbour, and commensurate with actions being taken.

*H1 2015 alva data

Be part of the

Stakeholder Intelligence community