Executive Pay: Understanding the Reputational and Privacy Risks

A practical, evidence backed guide to assessing your company’s exposure to reputational issues arising from executive pay

Download a free PDF version of this report

Executive pay is a complicated, controversial – and, at times, toxic issue. It is probably not surprising to learn that 67% of all content analysed by alva on executive pay is explicitly negative in sentiment.

For companies this is a challenge. The greater the public outrage, the more negative attention the organisation attracts and the greater the likelihood its remuneration proposals will be voted down.

From an individual executive’s point of view, negative attention on pay packages invariably translates into scrutiny of private lives. This can be distressing, disconcerting and distracting for both the executive and the business.

In 2013, executive pay reforms saw the introduction of various measures for quoted companies including pay policies, annual remuneration reports, and shareholders votes (both binding and advisory) for quoted companies.

In November 2015, the UK Government published a Green Paper on Corporate Governance Reform. The Government’s paper is designed to ensure executive pay is properly aligned to long term performance, to give a greater voice to other stakeholders (employees and consumers) and to discuss the merits of extending this to large privately held companies.

The recent Green Paper makes proposals for:

- Strengthening shareholder voting rights

- Encouraging greater shareholder engagement with executive pay

- Strengthening the role of the remuneration committee

- Improving transparency on executive pay

- Improving long-term pay incentives

Executive pay is clearly an issue which will come under greater scrutiny from the government and the media in the next few years.

The advantage of executive remuneration is that it is a relatively foreseeable risk. Unlike other reputational challenges, companies can predict when it is likely to become an issue and therefore planning and mitigation strategies are easier to mobilise and implement.

We have outlined the key factors that drive a targeted campaign on executive pay, how to identify it at an early stage and how to proactively plan for it.

About this Paper

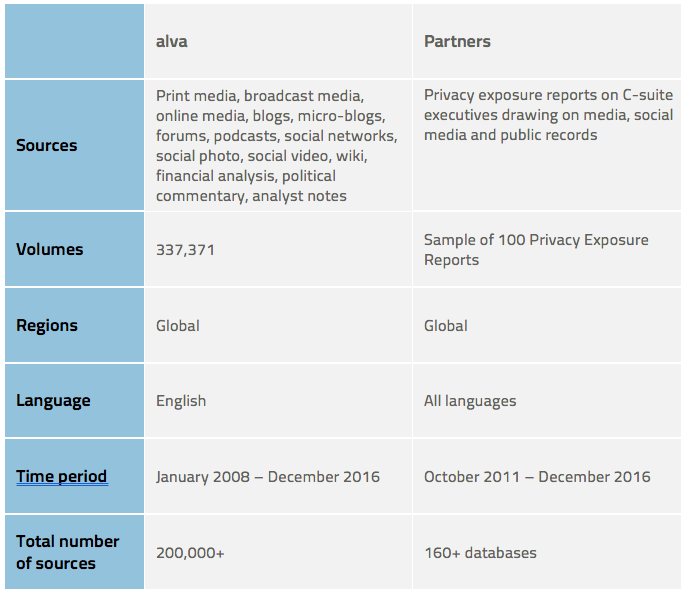

This paper is an update to alva’s Executive Pay White Paper, released in April 2016. For this 2017 version of the Paper alva has teamed up with an international reputation and privacy consultancy.

Using our leading-edge reputation intelligence capability, we have updated our insights, analysis and recommendations on the topic of executive pay.

Our partners have added practical advice on the topic, based on 30 years’ experience of helping protect the privacy and reputations of the world’s most successful individuals and leading companies.

Key Insights/Practical Advice

-

Stand out from the crowd

Executive pay is an issue where negative public perception is growing at a rate that outstrips the actual increases in pay levels. Executive pay is simply seen as excessive across the board

Practical advice:

The issues cannot simply be dealt with through a series of public relations initiatives. Companies must take a holistic approach and tackle the problem on a variety of different fronts. Reputation is relative; the aim is to distinguish your company from the herd and protect your executives in the process. -

Plan in advance

Executive pay should not come as a surprise, but companies are still caught out. It is a recurring annual issue so planning mitigation strategies two quarters prior to the announcement can help move from crisis response to proactive management.

Practical advice:

Companies should use the first two quarters prior to an announcement when there is a lull in interest in executive pay to prepare and plan. This involves understanding which pay packages may be disclosed and considering privacy protection strategies for key executives. -

Assess level of exposure

There are five factors which determine whether a company becomes a target of an ‘executive pay’ media campaign. These are: poor financial performance, misconduct, societal issues, CEO/employee pay ratio and activist investors.

Practical advice:

Companies must take an honest look at each of these factors to assess their risk of exposure. This enables a realistic expectation of what is likely to happen in the build-up to the AGM. Understanding this risk level can galvanise cross-company support for a coordinated response should the organisation be targeted. Forewarned is forearmed. -

Early warning indicators

Quantitative reporting and analytics can act as an early warning indicator that a company is likely to become the subject of a campaign. There is no point having a fantastic mitigation strategy designed if it is only deployed once the story has broken.

Practical advice:

Companies should monitor the specific risk factors before they are targeted. Understanding the company’s “baseline” in terms of quantitative reporting will enable the detection of any divergence at an early stage. This will allow companies to respond quickly. -

Reduce level of executive exposure

The perception of executive pay is highly-charged and emotive; individuals are at risk of being targeted personally. This is intrinsically linked to increased availability of executives’ personal information and lifestyles.Practical advice:

Companies should minimise superfluous public information about their executives in order to minimise privacy and security risks. Where possible they should ensure social media accounts for the executive and their families are private, that they take care when posting on other people’s social media accounts and that unnecessary information about assets are removed from the public domain.

Supporting evidence

There is a disparity between content dedicated to the issue of executive remuneration and the increase in executive remuneration. A point has been reached where executive pay is simply seen as excessive, irrespective of the size.

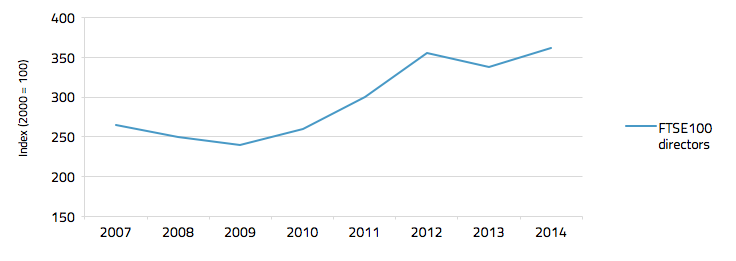

Given the differing opinions over the size and speed of increase in executive pay, it is informative to analyse the available data to understand whether changes in media and public focus on CEO pay correspond to changes in the pay itself. Put another way, does media and public scrutiny increase only when pay increases?

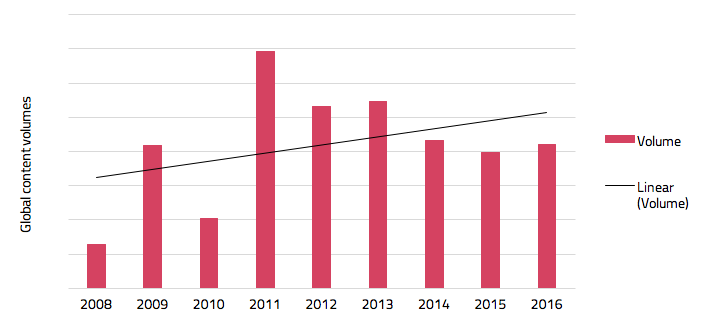

Figure I below is a graph charting the rise in remuneration for FTSE100 executives over the past eight years.

Alongside this, we can observe in Figure II the amount of content dedicated to the issue of executive remuneration in publicly-available sources over a similar period.

While pay levels have increased by 44.8% over the period, coverage levels have soared by 235%.

There is a clear disparity between the two, indicating that the concern about pay has decoupled from the reality of pay levels themselves.

Figure I: Executive pay for FTSE100 executives: Indexed median earnings movements

Figure II. Volumes of executive pay coverage in public sources over time

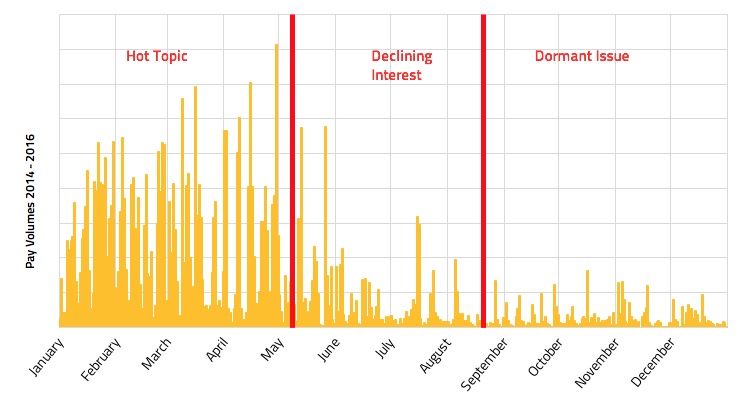

Media coverage of executive pay follows a recurring three phase pattern each year that can be predicted and planned for.

Executive pay has the advantage of being relatively predictable because the pay discussion centres on the company’s AGM with a very clear issue lifecycle.

Based on volume of executive pay issues in the media we can see a pattern playing out each calendar year in three stages:

- January – May: “Hot Topic” – executive pay becomes a growing focus, amplified by other factors such as bankers’ bonuses, winter fuel prices or the day in the year when the average CEO’s pay exceeds the average worker’s pay (“Fatcat Tuesday”). Executive pay takes centre stage during AGM season (March/April) because of voting on executive pay.

- May to August: “Declining interest” – we see a drop-off in interest as the media and public agendas focus elsewhere.

- September – December: “Dormant issue” – the topic of executive pay is relegated to background information on a company or executive

What this means for companies is that it is often too late to start planning a response in Q1 – by then there is scrutiny on the organisation and it may already have become a target. A company should take advantage of the lull in interest in executive pay in the summer and autumn to plan and prepare for this reputational issue.

This approach can prevent organisations from falling into the trap of operating solely in crisis mode – often an inefficient, expensive and ineffective remedy.

Figure III: Volume of media coverage concerning ‘executive pay’ over a 12-month period

Other factors are important in determining whether a company is likely to become a target.

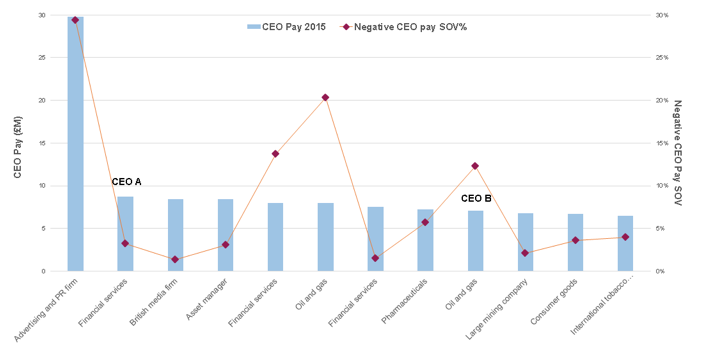

Research indicates that it’s not simply the case that the highest paid earners receive the greatest attention. There are other factors at play in determining whether a company is targeted over the issue.

As the chart below shows, we have examined 12 CEOs’ pay against their negative “share of voice” in the media. What is clear is that the two do not correlate.

- CEO A has second highest pay but only 3% negative share of voice.

- CEO B has the fourth largest share of voice but the ninth largest executive pay package.

Figure IV. Executive pay volumes for 12-months period (2015) on mainstream and social media

Why is CEO A faring better than CEO B? The size of pay accounts for 26.5% of all coverage but the combination of five other factors contribute the remaining 73.5%. It is these other factors that will influence negative share of voice.

Analysis of the factors which are commonly presented alongside reporting on executive remuneration (and therefore factors which increase the likelihood a company will become a target) are as follows:

- Poor Financial performance

- Pay awards contrasted with financial performance

- Pay and financial targets linked

- Misconduct

- Pay positioned alongside regulatory concerns, lawsuits or investigations

- Pay contrasted to historic misdemeanours including fines

- Societal issues

- Pay of CEO compared to customer satisfaction, customer safety

- Public “ownership” (past or current) of company contrasted with pay awards (including state bailouts and formerly publicly-owned firms)

- CEO/employee pay ratio

- CEO: employee pay ratios and differential highlighted in reporting

- Relevance of industry to CEO/employee ratio (from 2016)

- Activist investors

- Presence of activist investors in company and pressure/advice made on pay votes

The presence of more than one factor dramatically increases the likelihood that a company will be subject to public scrutiny. All of the top five most negatively covered companies for executive pay had a least two of the five factors present, with several containing three or more. One company had all five factors present.

These factors are particularly pertinent given proposed reforms as set out by the government Green Paper.

One of the proposals under discussion is whether companies should publish ratios comparing CEO pay. This would be used as a metric to compare companies, particularly over the same sector and a means of establishing trends. Publication of this ratio has been a requirement in the US from January 2017.

This may result in a greater focus for companies in the retail sector where there will be a higher ratio compared to financial service companies where there will be a lower ratio. Therefore, industry sector may become an increasingly relevant consideration.

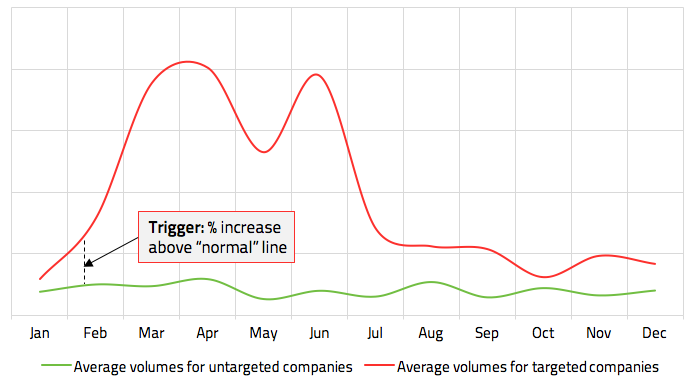

Analytics can act as an early warning indicator that a company is the subject of a campaign.

The chart below shows the different levels of attention received by targeted and untargeted companies in the run-up to their AGMs. The start of a significant divergence in attention acts as a quantitative trigger, signalling that the risk threshold has been breached.

Armed with quantitative analysis, companies can determine on a daily basis whether reporting on their executive remuneration has reached “targeted” level. Once it has, the plans drawn up in Q3 and Q4 can be deployed.

Figure V: Average volume of media coverage for targeted/untargeted companies

The perception of executive pay is highly-charged and emotive; individuals are at risk of being targeted personally and this has privacy and security implications for their families.

This is intrinsically linked to increased availability of executives’ personal information and lifestyles.

What might be driving this trend? Two of the key contributing factors are:

- Volume of available public information – there is much more information available on pay structures, bonuses, house prices, and people’s spending habits and lifestyles.

- Accessibility of publicly available information – it is quicker and easier to access this information not only for shareholders but journalists and the general public.

Therefore, the “executive pay” story is one that can be amplified by reference to the executive and their family’s lifestyle, spending habits, planning applications and so on.

Based on over 100 privacy exposure assessments, our reputation and privacy consultancy partners identified that:

- 82% of executives had an adverse finding in relation to their physical privacy (for example availability of their private residential address)

- 69% of executives had a negative reputational issue in relation to their social media accounts or those of their close family

Executives can help themselves and their families by minimising the volume of private information available on them and their families in the public domain.

Executives can mitigate the threat by making themselves an unattractive target. Start with a risk assessment on what is available. A good way to think about the content is the five Ps: posts, profiles, pictures, public records and private records.

While some of the content is required to be made public (for example disclosure in financial statements, company appointments or land ownership records) much of it is superfluous and unnecessary (Instagram photos, tweets).

Executives are usually surprised to find how much information is available on them and their families and the extent to which this can legitimately be removed.

Methodology

Be part of the

Stakeholder Intelligence community