The “death of cheap mortgages”: are banks prepared for the reputation challenges?

- Pricing is a major contributor to the reputation of mortgage providers

- An interest rate hike could risk the reputation of those with the most attractive deals

- Challenger banks could stand to gain as the best offers of the larger banks are withdrawn

Interest rate uncertainty

Murmurings of an interest rate rise are leaving consumers wondering which deal is best for them in the current climate. A looming hike is seeing a rush for fixed-rate deals before the best of them are withdrawn: “Savvy homeowners are snapping up competitive deals before an expected increase in interest rates”, the BBA’s Richard Woolhouse recently commented*. Consumer media is also playing its part in revising recommendations, for example towards tracker mortgages to hedge against unpredictable movements. The uncertainty is further added to by macroeconomic factors which have struck of late, such as falling commodity prices and turmoil in the Chinese stock markets.

The influence of rate changes on a mortgage provider’s reputation

But how much does the strength of a bank’s reputation actually hinge on pricing? alva’s UK mortgage sentiment data from 2014-2015 shows pricing and coverage of “best-buy” tables are key drivers of mortgage recommendation – in some cases even more so than products such as current accounts. The launch of the Current Account Switching Service (CASS) means that current account customers can easily (and impulsively) switch banks on grounds other than pricing – for example customer service, mobile app functionality or in protest over tax avoidance – a luxury mortgage customers cannot afford without a 4-8 week wait and much more time and paperwork. Nevertheless, this does not inhibit customers from voicing their grievances over customer service, processing times and becoming mortgage “prisoners”, locked into unfavourable deals.

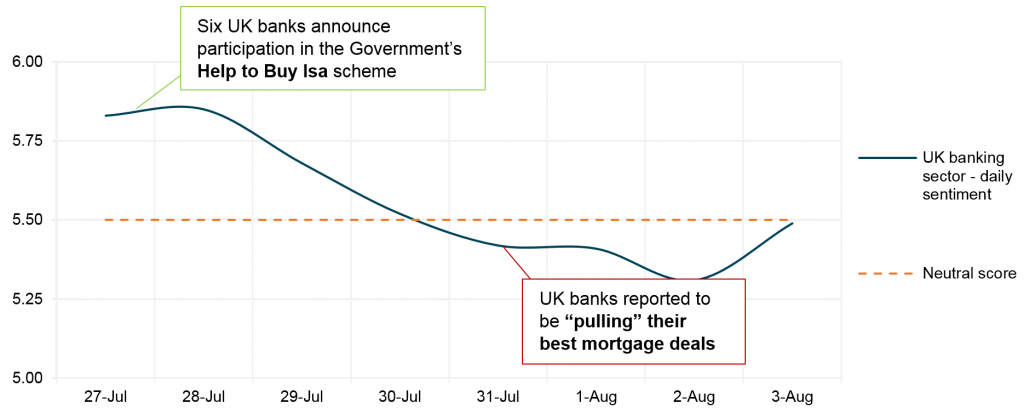

The death knell of cheap mortgages then, if and when it arrives, presents a reputation risk to mortgage providers – particularly those acclaimed for their record-beating mortgage rates or propositions built upon rewards and pricing (consider HSBC’s “lowest-ever” 0.99% mortgage launch in October last year, or Santander’s cashback offer on mortgage payments for 123 current account customers). Negative media attention to banks “pulling their most attractive offers” and “adding hundreds” to the cost of mortgages began to emerge in July, weighing down slightly on sentiment scores for the UK banking sector in July and August:

Leveraging the spotlight

The present climate also presents emerging opportunities, as the topic is invigorated by ongoing mainstream, trade, consumer and social media discussion around new and anticipated changes to pricing. This presents an opportunity to challenger providers benefiting from increased attention to the “best-buy” status of their fixed-rate deals while the incumbents nudge up their interest rates. But larger banks, too, stand to benefit from the spotlight – particularly given the vocal political backing and support for those participating in the Help to Buy Isa scheme launching in December 2015.

* Reuters, “UK Mortgage Approvals Rise to 17-month High in July – BBA”, 26th August 2015

Be part of the

Stakeholder Intelligence community