Executive Pay in Financial and Professional Services: An increasingly visible issue

alva’s analysis highlights the recent reputational impact of executive pay issues for financial and professional services companies throughout 2022.

In the context of global inflation, executive pay continues to be scrutinised. Financial Times reports that between December 2019 and March 2022, pay increased by 7% in real terms for the top 1%, whereas, for the bottom 10% of earners, wage growth was just over 2%.

alva’s latest report examines the visibility of this issue for financial and professional services companies and how it has gathered momentum throughout the year, with some firms facing an increasingly negative response from their stakeholders.

Key findings of the report include:

- Growing visibility of executive pay issues, peaking in Q2 2022, with Barclays and Blackrock most visible.

- We see various challengers to executive pay are contributing to this increased visibility, including proxy voters and advisory led by Glass Lewis, Institutional Shareholder Services (ISS), Pirc, regulators in China, and the Bank of England in the UK.

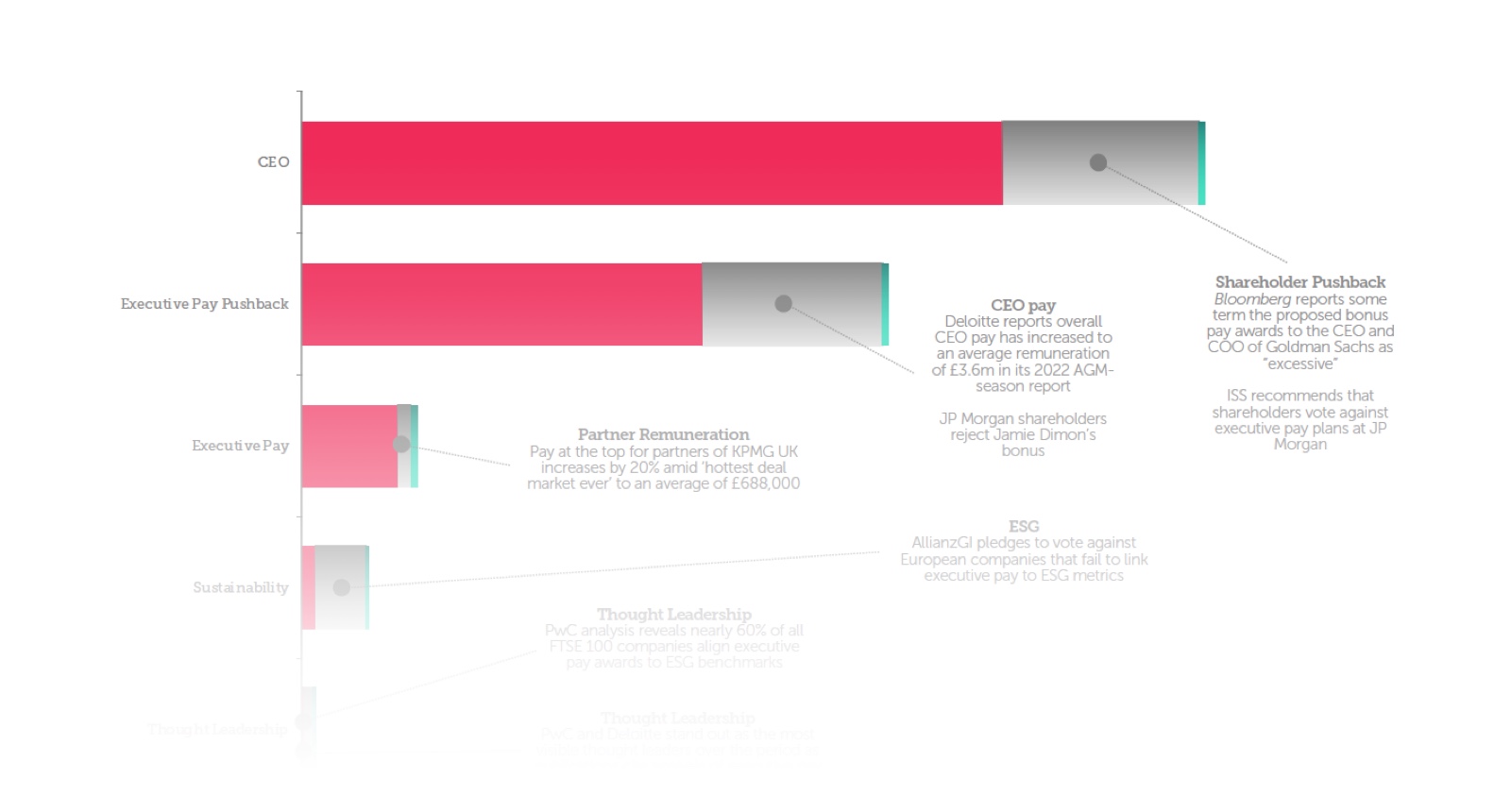

- CEO pay is the most dominant issue within the topic of executive pay, generating mostly negative coverage.

- Goldman Sachs, JP Morgan and Barclays lead on receiving negative sentiment due to executive pay.