Which are the key issues that matter to banking stakeholders in the lead-up to COP27?

As COP27 approaches, alva’s analysis reveals the impact that COP26 had on banks’ behaviour – and the sustainability issues that are most important to their stakeholders.

Following COP26 last year, several financial institutions were encouraged to review their green credentials, with some signing up to the Glasgow Financial Alliance for Net Zero. Since then, many banks have launched innovative approaches to sustainability, gaining encouraging responses from their stakeholders.

alva’s latest report – covering January to August 2022 – looks at how the global conference impacted banks, the visibility of sustainability issues, and how banks’ handling of ESG has progressed over time.

Key findings of the report include:

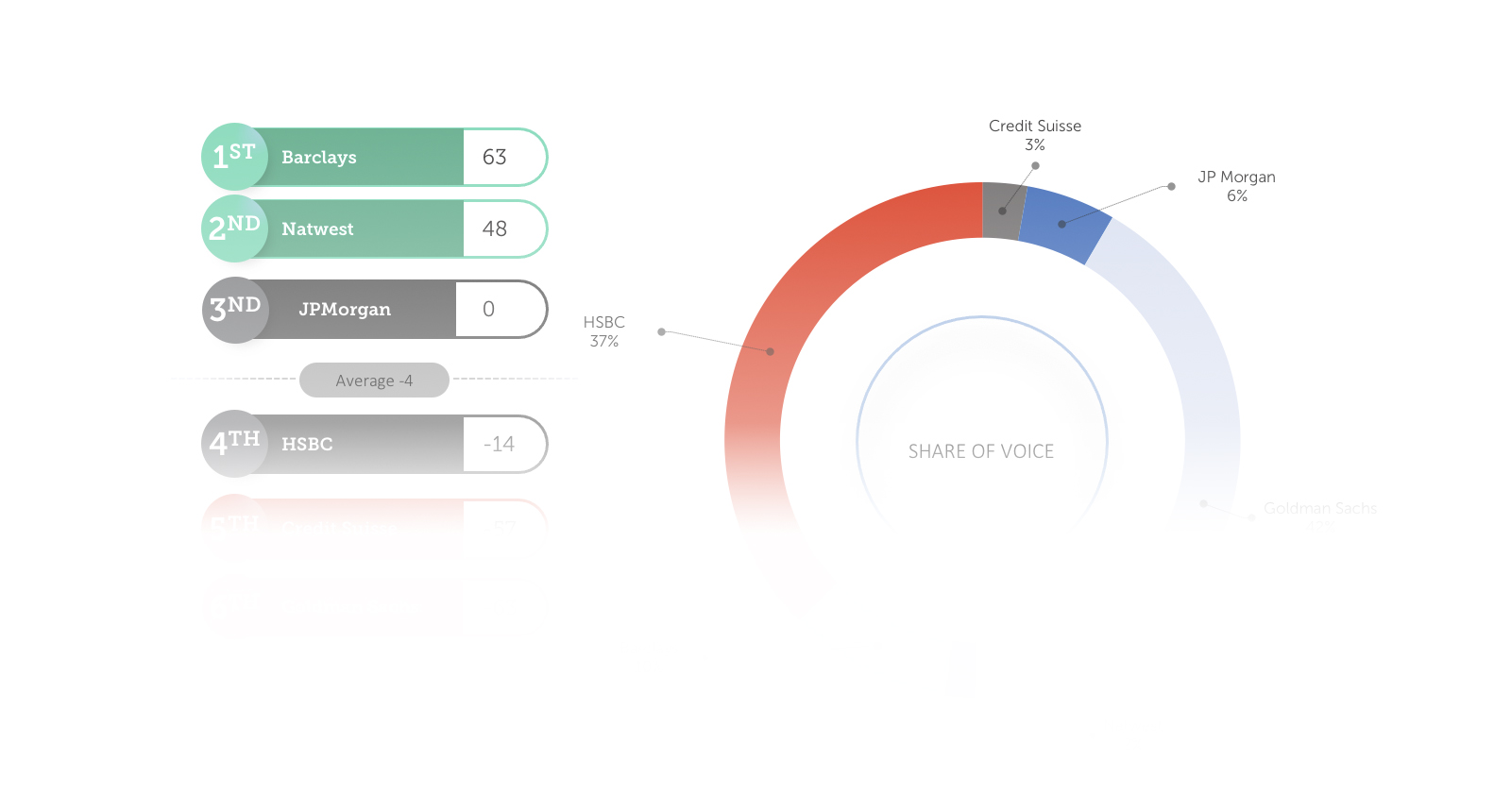

- Barclays achieving the highest sentiment score of 63 after partnering on Property Week & UKGBCs’ Climate Crisis Challenge.

- Renewable energy featuring heavily in coverage surrounding COP27, with Goldman Sachs advocating for investment in green hydrogen production in Africa.

- NatWest gaining a sentiment score of 48 after dedicating $100bn to fund and support climate and sustainability-related projects by the end of 2025.

- Gas being the most visible issue in the backdrop of COP27, as Europe looks for alternatives to Russian energy.

Download the full report here.