Pharma and Artificial Intelligence – Communication’s next frontier

Artificial Intelligence’s disruptive powers are a familiar discussion topic in most sectors and pharma is no exception. Since late 2017, it has slowly become an increasing priority for the sector, with discussion catalysing in the last 12 months as firms jockey for position to be seen as early adopters of the technology.

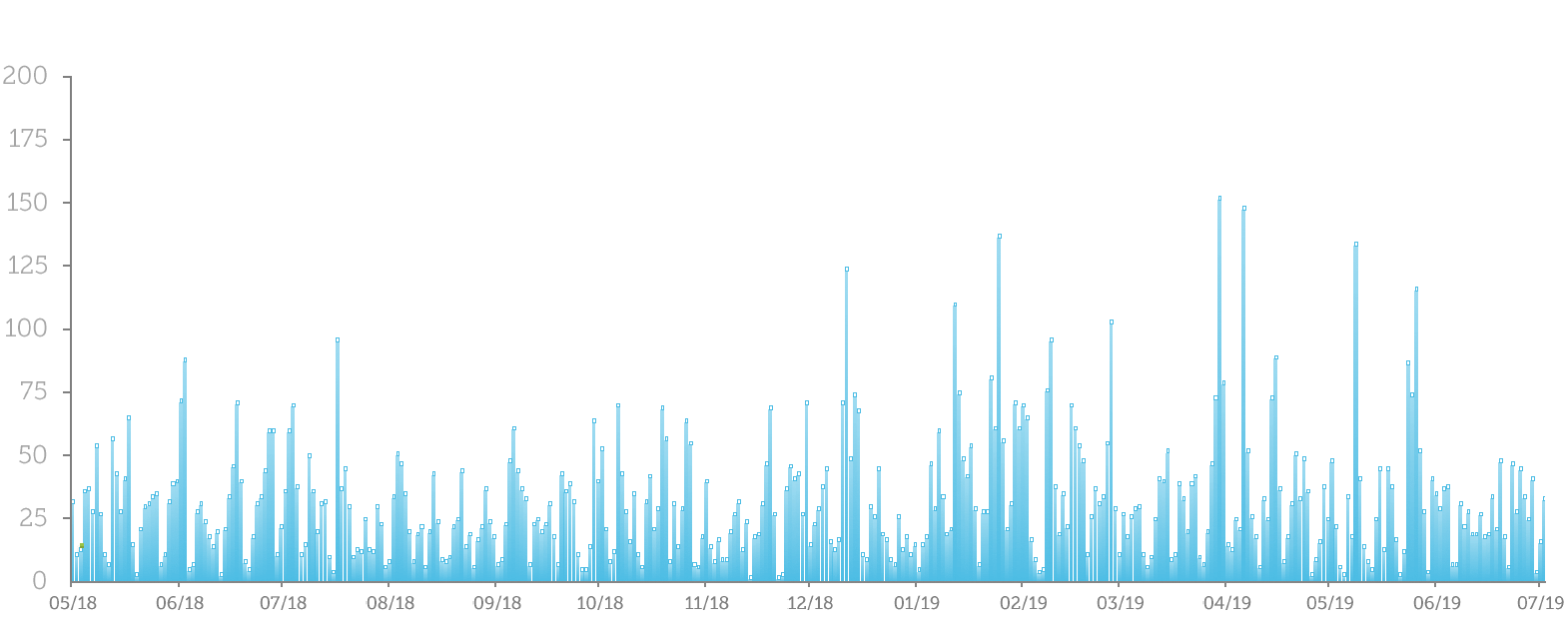

Figure I Proactive Communications of Pharma firms on Artificial Intelligence – last 12 months

In this short piece of analysis, we look at the different adoption phases experienced by any sector when introducing new technology and how this affects the communications approach. We also analyse the winners of each phase so far, basing our analysis on 12 months of data for ten companies: AstraZeneca, Bristol Myers-Squibb, GSK, Johnson &Johnson, Eli Lilly, Merck, Novartis, Pfizer, Roche and Sanofi

Phase I: The Phoney War

First movers in any tech trend tend to focus on the investment aspect – announcing intentions to acquire or partner with firms specialising in the new specialty, while also dialling up the credentials of their new hires or existing staff.

While often lacking in substance, this initial “phoney war” is an important communications battle in which companies vie to position their strategy as future-proofed and more advanced that their competitors through leveraging the newly available technology. The play is largely to investors considering the longer-term prospects of the firm and potential employees evaluating the differentiation between companies in the same sector.

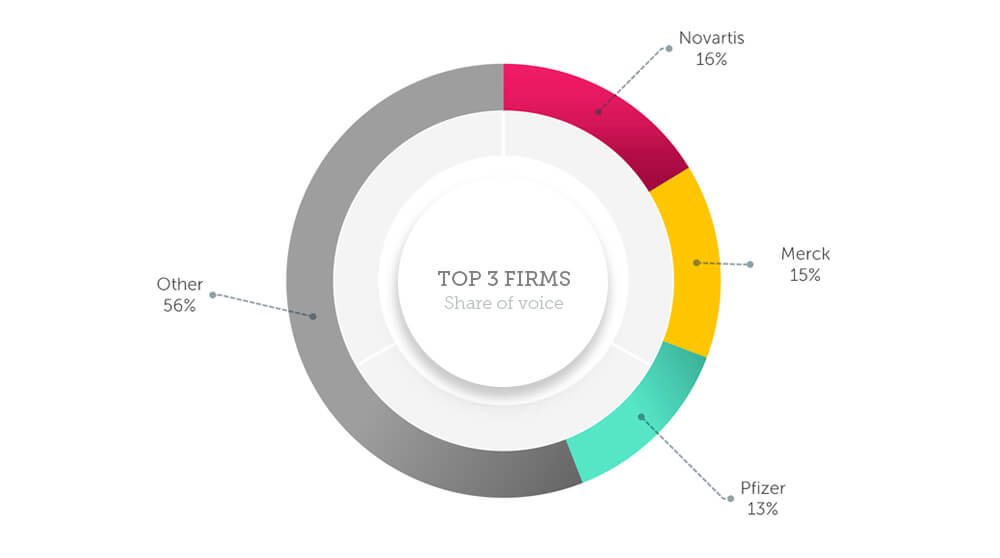

Figure II Top 3 Pharma Firms by Proactive AI Communications Share of Voice

In pharma we can see that the early movers throughout 2018 were Novartis, Merck and Pfizer, all of whom went big early on the messaging, with Novartis in particular leveraging its CEO and his Silicon Valley background to good effect to steal a march on the competition.

At this stage, it is more of a numbers game – visibility in key areas is the win, with owned communications dominant and little serious evaluation or comparison of the competing companies’ claims given the immaturity of the technology’s application.

Phase II: The Stakeholder Sell

Once we move into the Early Majority phase – in pharma’s case with AI circa January 2019 – the terrain changes as do the success criteria.

Now we have a noisier, more crowded domain, one in which simply pledging one’s investment in the technology is mere table stakes, rather than a source of differentiation.

In this arena, the focus shifts to application and implementation – what you’re doing with the technology and why. Once again, owned communications and visibility of these is key, but there is more critical evaluation, greater understanding and assessment of the genuine capability and impact of the technology.

Different stakeholders want to understand what’s potentially in it for them (or not in it for them in some cases). Investors want to understand how it will affect their returns, researchers how it will enhance their science, employees whether it will put them out of a job.

We’re entering a more nuanced and therefore more delicate period and the communicator’s craft becomes ever more vital; how to manage the competing demands of different audiences without being inauthentic – all things to all people.

As our analysis shows, while Novartis was the standout performer in the Early Adoption phase, there are many more companies who are seeking to credibly establish themselves as leaders in this space.

AstraZeneca and Roche in particular have been especially active since the turn of 2019 and both companies have put the application of their technology at the heart of their messaging.

Phase III: Outcomes

With Novartis, Merck, Pfizer, AstraZeneca and Roche currently heading the pack, the next phase – Outcomes – has not yet been reached by any of the leading pharma companies.

This is when the results of the implementation are shared and we move from potential to reality.

Whoever arrives there first with a credible, quantified story to tell, will have established themselves as the poster child for this technology within the sector and can expect to enjoy the reputational spoils that come with this competitive differentiation.

This blog is an excerpt from a larger analysis of the pharmaceutical sector and AI. To speak to us about this or any other matter, please contact us

Be part of the

Stakeholder Intelligence community